Your VA Home Loan Explained

One of the most significant benefits of military service is the VA home loan which can help you purchase a home or refinance an existing loan. This gives you the opportunity to get a mortgage with a competitive interest rate as well as a lower cost at closing without prepayment penalty. VA Home Financing is one of the few options available today for no money down mortgage financing. In addition, it gives increased buying power as the allowable loan-to-value and debt-to-income ratios are more generous than for conventional financing. These benefits give you the potential to buy a more expensive home than you might otherwise have been able to afford.

The VA does not actually loan you the money. They guarantee a loan made to you by a lender i.e. banks, savings & loans or mortgage companies. If a home loan is approved by your lender, the VA will guarantee a portion of that loan to the lender.

There is no maximum to the amount of the loan, but the VA does have a limit to how much it will guarantee. This limit can vary around the country and is based on which State & County the property is in. To find out what your area limits are click here:

www.militarybenefits.info/va-loan-limits-by-county

Benefits of VA Home Loans include:

1. No down payment as long as the sale price does not exceed the appraised value.

2. Loan-to-value ratio of 100%

3. Back-end debt-to-income ratio of 41% under certain circumstances

4. No private mortgage insurance

5. Limits on Closing costs, which may be paid by the seller

6. No penalty for early payoff

7. Loan is assumable by another qualified veteran borrower

8. Ability to apply for a new loan two years or sooner after a bankruptcy

9. The VA has no loan limits, only a maximum that can be borrowed with a zero down payment.

Are You Eligible for a VA Loan?

There are several categories for eligibility, but here are some of the major ones:

1. Veterans and service persons who have served more than 181 active-duty days during peacetime, unless discharged or separated from a previous qualifying period of active-duty service.

2. Veterans who served during WWII, Korea or Vietnam, if they served for 90 days and were honorably discharged.

3. If you have served for any period since August 2 1990, you can also qualify if you have served 24 months of continuous active duty, or the full period that you were called to active-duty (at least 90 days).

4. Have completed a total of 6 years in the National Guard or Selected Reserve.

5. Any spouse (who has not remarried) of a veteran who died while in service or from a service related disability, or a spouse of a serviceman MIA or a POW.

For full details of eligibility requirements click here:

https://www.benefits.va.gov/homeloans/purchaseco_eligibility.asp

What if you have lost or destroyed discharge papers? You will need to obtain a Certificate of Military Service. This can be achieved by completing GSA Form SF-180 and can be completed online at:

www.archives.gov/veterans/evetrecs

You will need this in order to apply for your Certificate of Eligibility unless you have your discharge papers.

How to Apply for a VA Loan

There are several basic steps in the VA home loan application process. The first thing you need to do is get your Certificate of Eligibility. This proves to the lender that you are eligible for a VA loan. Information on how to obtain this Certificate can be found at:

https:// www.benefits.va.gov/HOMELOANS/purchaseco_certificate.asp

If you are not sure whether or not you qualify for a COE you can visit the VA’s eBenefits website:

www.ebenefits.va.gov/ebenefits-portal

You can also contact the VA Eligibility Center by mail at P.O. Box 100034, Attn: COE (262), Decateur, GA 30331.

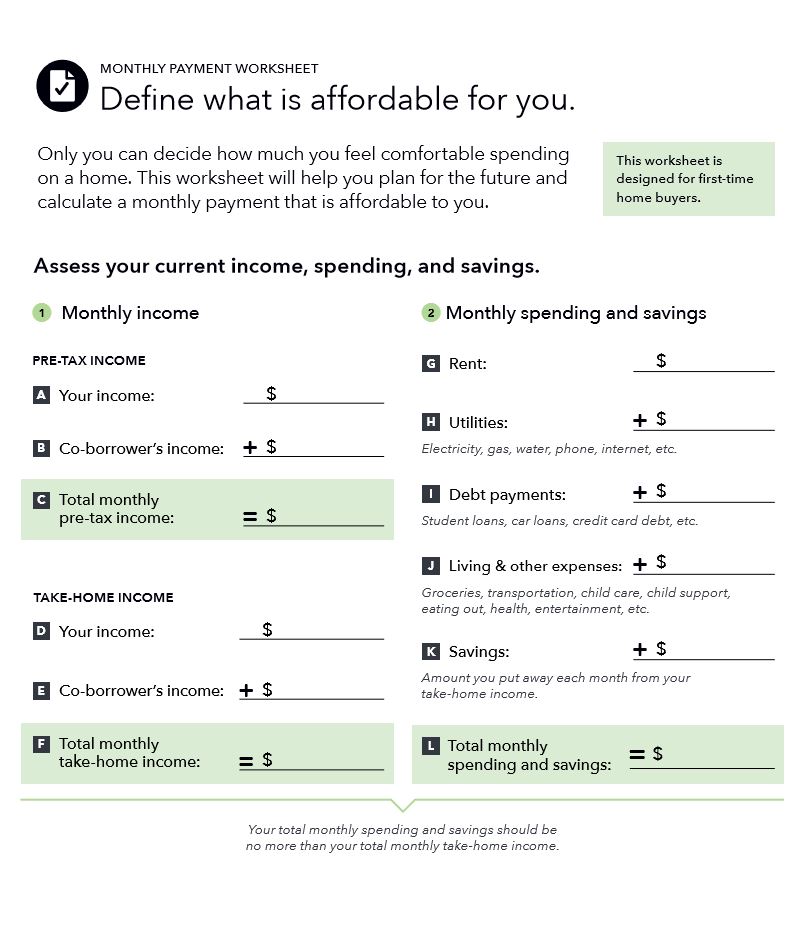

Once you have your COE, now you can approach lenders to find out much you can borrow and get your letter of Pre-Approval. This letter can often help in the offer process as it shows the seller that you are able to get a loan to purchase the house. Here is a sample form that you can use to work out ahead of time what you can afford. If you would like a copy of this worksheet please give me a call and I will be happy to send it to you.

There are many different types of mortgage available and you should definitely shop around for the best rates and terms. Here is a link to the Consumer Financial Protection Bureau website that will give you lots of info on mortgages and a mortgage calculator.

https://www.consumerfinance.gov/owning-a-home/loan-options/#loan-term-calculator

So, now you have chosen your lender, you have your letter of Pre-Approval in your hand – IT”S TIME TO GO HOUSE SHOPPING! Please make sure you find yourself a good Real Estate Broker with excellent knowledge of the VA loan process.

You’ve found your dream home! Now what? With the assistance of your Real Estate Broker you will make a formal offer to purchase the house and once the offer has been accepted and contracts signed you will start the process of submitting your mortgage application. You will be required to submit a significant amount of paperwork as evidence to support your ability to qualify for the mortgage.

VA Document Checklist

* Certificate of Eligibility; Obtain VA Form 26 1880.

* Complete Bank Statements from the most recent three months for all accounts

* Most Statements from retirement, 401k, mutual funds, money market, stocks, bonds & inheritances

* If applicable copies of spouses financial accounts and phone numbers

* Latest credit card statements, including minimum payments and account numbers

* Name, address and phone number of your landlord, or 12 months of cancelled rent checks

* If you have no credit card bills copies of your most recent utility bills

* If applicable, copy of complete bankruptcy and discharge papers

* If you co-signed for a mortgage, car, credit card etc., copies of 12 months cancelled checks

* If applicable copies of spouses credit card accounts

* Copy of drivers license

* Copy of Social Security Card

* If applicable, copies of complete divorce, palimony or alimony paperwork

* If applicable, copy of Green Card or Work Permit

If you are refinancing or own rental property you may also need to provide the following:

* Copy of Note and Deed from current loan

* Copy of Property Tax Bill

* Copy of Homeowners Insurance Policy

* Copy of Payment Coupon for current Mortgage

* If Property is Multi Unit, copies of rental agreements.

So, I’ve already mentioned that you can get a 100% loan from the VA, BUT, that does not mean that you will have no costs. The VA charges a Funding Fee which varies depending on your personal circumstances and ranges from 1.25% up to 3.3%. Your mortgage lender may also charge an Origination Fee of up to 1%. The Origination Fee must include the following charges:

* Settlement fee

* Any additional appraisals and inspections

* Escrow, closing fee

* Document preparation

* Underwriting fee

* Processing Fee

* Application Fee

* Interest rate lock-in

* Attorney fees (for work other than title)

* Assignment fee

* Photocopying

* E-mail or fax

* Photographs

* Postage

* Amortization schedule

* Notary fee

* Commitment fee

* Marketing fee

* Trustee fee

* Truth in lending fee

* Tax service fee

There are however some expenses that are NEVER paid by the VA borrower:

* Termite/pest inspection

* Attorney fees as a benefit to the lender

* Mortgage broker fee

* Prepayment penalties

* HUD/FHA inspection fees to builders

* Real Estate professional’s commission

Misconceptions About VA Financing

Some common misconceptions about VA eligibility and entitlement include:

* Eligibility for VA financing means guaranteed qualification for a loan, even with bad credit – Not true, every lender has different criteria for credit scores. Check with your lender to find out what their minimum score requirements are.

* A bad credit report doesn’t matter because the VA guarantees 100% of the loan even if the borrower defaults on the payments – The VA does not guarantee 100% of the loan and your credit report/score is a vital component of qualification for a mortgage loan

* A preapproval or prequalification isn’t needed when the buyer plans to use VA financing – This letter from your lender can be an important negotiating tool during the Offer to Purchase Process.

* VA financing can only be used once – Veterans who had a VA loan in the past may still have remaining entitlement to use for another VA loan. Selling the property and paying off the loan fully restores the entitlement for future use.

WOW, that’s a lot of information! The process of finding

and buying a house can seem completely daunting, especially to the first

time buyer. All the more reason to get yourself experienced help from a

licensed Real Estate Broker who will help you through from start to

finish. They will offer advice, knowledge and support and will be able

to connect you with other professionals in the area such as mortgage

lenders, closing attorneys and home inspectors.

I hope that you have found the information in this blog useful, but if you have any questions or need more information please do not hesitate to give me a call or email me. I will be happy to sit down with you and go through the process in detail from beginning to end.

Here at Century 21 Sterling Real Estate we are looking to actively support our military. We offer financial assistance to transitioning military who would like to pursue a career in real estate. We also offer that assistance to trailing spouses where appropriate. Century 21 also offers incentives for veterans. If you would like to receive a copy of the brochure “Heroes Wanted” please call or email me. Come join us and discover innovation to feed your relentless drive.

Valerie McKean, GRI, ABR, MRP, SRES

Owner/Broker & Military Relocation Professional

Century 21 Sterling Real Estate

95 Market Sq. Suite 2B

Pinehurst NC 28374

Tel: 910-430-9494

email: valerie@pinehursthomes.com

website: www.pinehursthomes.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link